Our previous column, “Luxury Purchasers: Who Are They and What Are Their Interests?,” focused on our finding that luxury goes way deeper than the affluent market segment with

household incomes of $75,000 or more. All luxury purchasers — adult consumers (18+ in age) who bought one or more luxury goods or services in the prior 12 months — constitute almost 20%,

or about 46 million, of the 239 million adults in the United States. Luxury marketers would be correct in surmising that as household income increases, the proportion of luxury purchasers

rises.

Notably, though, luxuries were bought by almost as many mass-market consumers whose household income is less than $75,000 (20 million adults who are not typically

classified as affluent by marketers) as by those with household incomes of $75,000 to $249,999 (about 22 million affluent consumers), plus the four million luxury purchasers in the upper-income

segment of $250,000 or more. This being so, it’s our point of view that the luxury market is actually much larger than many luxury marketers currently believe. After that column appeared, a

number of readers asked me the following three questions that delve into how valuable the three luxury buyer market segments are:

advertisement

advertisement

1. How many times did these consumers buy a

luxury in the past 12 months? How do mass-market consumers compare with the more affluent consumers?

2. How much did these consumers spend on their most recent luxury purchase?

3. How was the most recent luxury purchase bought (with cash, on credit, from savings)?

As might be expected, a relatively large proportion — one in five (21%)

— of mass-market luxury purchasers bought luxuries just once in the past 12 months. In contrast, more than one-third of very affluent luxury purchasers bought luxuries six or more times.

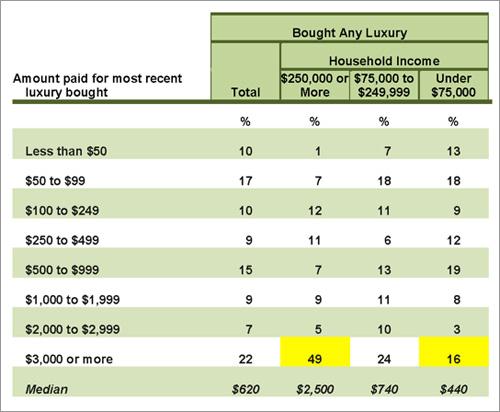

Concerning what consumers spent on their most recent luxury purchase, the median dollar amount reported ranges from $440 among mass-market purchasers to $2,500 among very affluent

purchasers in the $250,000+ segment. Notably, almost one half of the very affluent purchasers spent $3,000 or more on their most recent purchase. But about one in six of the mass-market purchasers

also spent $3,000 or more, a finding that luxury marketers most likely will find surprising.

While a majority (62%)

of very affluent purchasers paid for their most recent luxury with available cash, almost one half (47%) of mass-market purchasers saved up the money to buy their luxury item. Credit was used by about

the same proportion (more than one-fifth to one-quarter) of the three household-income segments.

While it is likely that

luxury marketers wish that all luxury purchasers could behave in the same way as the affluent and very affluent luxury purchasers, it’s our point of view that mass-market consumers should not be

overlooked — especially in the more affordable luxury categories (wine, spirits, beauty, etc.). After all, doesn’t it all go to the bottom line?