Commentary

The Whole Story - The Diet Pepsi Media Challenge

- by Mike Bloxham , Op-Ed Contributor, April 25, 2013

The carbonated drinks category is a fiercely fought sector in which consumer habit and loyalty is a key driver of

success. The category is so large that even when it is broken down by brand and sub-brand – of which there are many – loyalists for any sub-brand still number in the millions.

Understanding their daily media habits is critical in understanding how best to shape communications strategies.

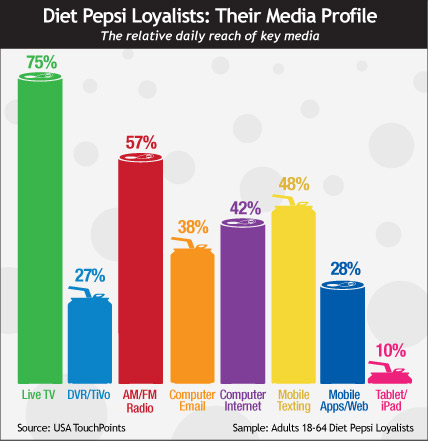

This analysis leverages the fact that USA TouchPoints data is linked back to

the MRI Codebook to enable analyses at the level of brand and category purchasers and consumers. It looks at the relative daily reach of different media among 18-64 year-old Diet Pepsi loyalists

–—those who drink diet cola and who always choose Diet Pepsi.

advertisement

advertisement

The medium that achieves the greatest average daily reach is Live TV at 75%, but the very respectable second

place is taken by Radio at 57% — possibly because other analysis has revealed this group to be on the move a good deal of the day and as we know, radio dominates the world of in-car media.

While the Internet via the Computer comes in fourth place at 42% (lots of workplace consumption no doubt), it is sandwiched between two media often overlooked in the world of Big Media: Mobile

Texting (48%) and Email via the Computer. Though neither are regulars on the media plan, their daily reach among Diet Pepsi loyalists – and probably other consumers of carbonated drinks –

is too high to responsibly ignore. Even though much of the email use will be work-related, there is ample evidence to suggest the mediums potential for consumer engagement.

Interestingly Texting delivers a full 20% more reach than the combination of Mobile Apps and Web – which may come as something of a surprise to many in the media industries who are more

enamored and heavier users of apps and Web browsing on our phones. But that's not so forr the general population of Diet Pepsi loyalists.

Something similar may also be said for the reach

delivered by the Tablet. While this can reasonably be expected to grow, at a mere 10% right now, it is unlikely to justify anything more than experimental activity.

Such an analysis could

also be done in comparison to the sector as a whole or against specific competing brands and also to show how media use varies through the day and week. But as a simple check against which media are

most likely to deliver brand loyalists on an average day, even this analysis shows up some potentially enlightening opportunities for developing differentiated channel planning strategies.

Dear Mike - I hate to be a party pooper but this is terrible data.

First of all, it covers the target audience 18 to 64, so college kids to retiree's. Not Pepsi's core target me thinks, or at least largely not.

Secondly, obviously reach is only of relative use. Lets also look at cost per reach, brand comms objective, timing of message relative to message content, desired message context (e.g. sports vs Beyonce as content), etc. etc.

Let's hope that USA Touchpoints is capable of at least some of that, and ideally follows in the footsteps of its admirable, and well established UK namesake.

Hi Maarten - thanks for your comments. To respond to your points in turn:

The analysis is not based on adults 18-64. As made clear in the graphic and the accompanying text, it specifically relates to Diet Pepsi Loyalists 18-64 and no-one else. Rather than being bound by a demographic framework we chose to start from the relationship with the brand in defining the target - so this is undeniably an audience that is very important to the Diet Pepsi - regardless of age.

Your second point - that reach is only of relative use in informing a media or marketing plan - is obviously entirely correct and I don't believe I suggested otherwise. Reach, along with many other factors - some of which you mention - is important but only part of what has to inform decision-making. This analysis (in the space available) addressed that one issue. Many of the other contextual issues you mention are addressable with USA TouchPoints - just as they are with our counterpart in the UK.

To your final point, USA TouchPoints is closely based on Touchpoints in the UK and we have a close working relationship with the IPA (who adopted our measurement of mood and emotions in recent times and made the switch from PDA to Smartphone based on our experience). I'm glad to say that the vast majority of Madison Avenue media agencies, a growing number of creative and digital shops as well as major media owners are using USA TouchPoints to address exactly the kinds of points you rightly identify as critical to things such as campaign planning, media allocation, new business activity and so on - which would suggest that the data is not terrible after all.

Best regards,

Mike

Mike - thanks for your detailed response. This adds a lot of context to the article. For one, I did not know (but suspected) there was a kinship to the UK study.

Knowing a little about the beverage industry, I still think that even if the demo is made up of loyalists, the target is far too broad to be workable. The lifestyles and lifestage, as well as motivations to drink Diet Pepsi of a late teen vs an AARP member are just too wide to my liking.

But I appreciate there is far too little room in a short article to work out all of the details I am sure would be included in a full results and analysis presentation.

For me the best news is that there is a US equivalent to the excellent IPA work and that the US and UK version are beginning to "cross-pollinate" experience and best practices. Insights and plans can only get better from that!

m