The audiences watching TV and digital video are (mostly) the same, so why not use the same data to reach them in both places?

That’s exactly what more and more marketers are

doing.

According to programmatic video ad platform Videology, digital video advertisers used nearly twice as much TV data during Q2 2015 compared to Q1 2015. The number of digital video

campaigns that used TV data targeting segments was 91% higher in Q2 compared to Q1, per Videology.

The use of “TV data sets/segments” means that digital video advertisers are

attempting to reach the same audience via both TV and digital video ads. According to Videology, the most popular TV audience segments used by digital video advertisers in Q2 2015 were sports viewers,

political show viewers, news show viewers, primetime viewers and adults exposed to children’s programming.

A total of 15% of all digital video ad impressions were bought using TV data

sets, per Videology. That’s an increase of 64% over Q1 2015.

advertisement

advertisement

Demographic data is still used for all digital video ad buys, followed by behavioral (66%), geographic (66%) and domain

(50%). Those are the only data segments that are used more often than TV data segments, per the report. This means TV data segments are now used more often than user ID (12%), daypart (11%),

contextual (10%) and HHI (10%).

"With so much cross-screen data now at advertisers' fingertips, the planning siloes between TV and digital video campaigns are truly coming down.” stated

Scott Ferber, Videology’s chairman and CEO.

In a similar vein, Videology reveals that mobile video programmatic buying has skyrocketed over the past year. The company notes in its Q2

2015 U.S. Video Marketing report -- which is where all of this data comes from -- that there were more than 10 times the amount of mobile video impressions available for programmatic buying in Q2 2015

compared to Q2 2014.

One-quarter (26%) of campaigns ran via Videology's platform included both PC and mobile targeting, and 44% of campaigns included PC, mobile and OTV targeting. Another quarter (26%) of video

campaigns managed by Videology dealt only with PC targeting, while only 4% of the campaigns were targeted at only mobile devices.

In short, the data shows that while mobile is growing,

it’s growing as part of a larger cross-device movement. The data reveals that nearly three-quarters (74%) of the campaigns run through Videology’s platform during Q2 2015 included

mobile.

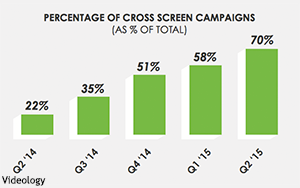

During Q2 2015, Videology notes that 70% of the campaigns it managed ran on more than one device (i.e. they were cross-screen campaigns). This is a big jump from Q2 2014, when only 22%

of the campaigns Videology managed were cross-screen.

Additionally, Videology found that marketers are putting a higher emphasis on viewability. The report notes that 31% of campaigns managed

in Q2 2015 were “specifically optimized for viewability -- a 165% increase over the same period last year.”

Videology’s full report can be found here.

This post was previously published in a recent RTBlog