Analyst Critical Of Pinterest Ecommerce Efforts

- by Gavin O'Malley @mp_gavin, July 6, 2015

Tempted by new revenue streams, every social network worth its salt has jumped on the “buy” button bandwagon.

Tempted by new revenue streams, every social network worth its salt has jumped on the “buy” button bandwagon. Yet, analysts say the efforts are premature, and not likely to transform ecommerce anytime soon.

“The energy … appears premature,” Forrester analyst Sucharita Mulpuru writes in a new report.

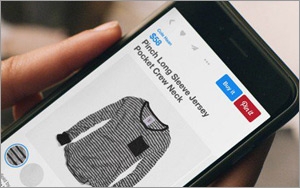

Announced in June, Pinterest only recently started rolling out a “buy it” button on its pins on iPhone and iPad apps. The picture-based network also launched new shop categories, including "Shop our picks" -- a curated selection of seasonal goods -- and "Shop" for the latest buyable Pins.

In the coming weeks, “pinners” are expected to have access to 30 million products from various retailers, including Macy’s, Neiman Marcus and Nordstrom.

Mulpuru calls Pinterest’s execution “weak” and “limited to what merchants have in inventory, which means the merchant needs to send real-time data on merchandise availability to Pinterest. That’s onerous in a category like fashion where size and color detail are critical and constantly changing,” Mulpuru explains.

“Furthermore, only a small number of items will be ‘buyable,’” according to Mulpuru. “Given Pinterest’s broad categories and breadth of photography, I expect the overlap will be relatively small.”

Another big problem for Pinterest is that users love pinning old items that are no longer for sale.

Pinterest is promising that they will get to 60% of their photos being “buyable” in the near future, but Mulpuru says she remains “highly skeptical of that figure.”

Yet, rival social networks could fare even worse that Pinterest.

Instagram’s early ecommerce, for instance, has little chance of success, Mulpuru says. “If Pinterest’s problem is that its pins have too long a lifespan, Instagram has the opposite problem: its image lifespans [sic] are too fleeting to have any impact with ‘buy now’ functionality,” she writes.

Twitter, despite pioneering the “buy” button among social networks, is even less likely to profit from ecommerce, according to Mulpuru. “Tweets are too ephemeral to make a

difference to a merchant in sales,” she insists. “Even if there was a buy button on any ad unit, few companies would really get much benefit from such an offering.”

Thanks to

its sheer size, Facebook is the best positioned to profit from ecommerce, Mulpuru suggests.

At the moment, however, the required investment is not worth Facebook’s time.

“It just doesn’t appear to have that much interest in winning at this,” she said in reference to the game of direct sales. “The value of any buy button is small potatoes in comparison to the company’s red hot ad business right now.”