As Mobile Results Improve, Desktop Search Value Erodes

- by Laurie Sullivan @lauriesullivan, July 15, 2015

If marketers don't make massive changes in

the capabilities on Web sites that make it easier for consumers to make purchases from their mobile phones, it's not likely brands will close the gap between falling click-through rates (CTR) and

rising cost per clicks (CPCs), according to research from Adobe Systems released Wednesday.

If marketers don't make massive changes in

the capabilities on Web sites that make it easier for consumers to make purchases from their mobile phones, it's not likely brands will close the gap between falling click-through rates (CTR) and

rising cost per clicks (CPCs), according to research from Adobe Systems released Wednesday.

More of Google's search ad business depends on mobile clicks, as Web browsing continues to move to the smartphone. In the second quarter of 2015, the Adobe Digital Index (ADI) estimates the worth of a mobile click at 37% less compared with a desktop click. The number improved from 44% from the first quarter of 2015.

"We're seeing progress, but for Google it's a major devaluation in mobile rates compared with desktops," said Tamara Gaffney, principal analyst at ADI. "On one hand it's about creating enough stress so marketers address mobile optimization challenges and, on the other, create more reasons to buy mobile advertising."

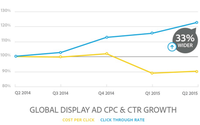

Brands that neglected to address mobile Web strategies after Google said it would update its algorithm in late April lost 10% of organic mobile traffic, compared with the prior year. Companies that needed a boost bought more paid search advertising, but marketers continue to see mobile advertising running on Google's network deliver less value at a greater cost, with a growing gap between mobile click-through rates (CTRs) and cost-per-clicks (CPCs). ADI reports mobile CPCs on paid search rose 16%, while CTRs fell 9% year-over-year.

Adobe also analyzed engagement for all categories, and revenue per visit for retail to see if companies doing their best can match desktop's returns in mobile campaigns. It turns out for engagement metrics brands can, per Gaffney. "If you're doing the best, brands can get the time spent, number of visits, stickiness, and pages to look like desktop visits when it's coming from a mobile device. In North America the best are able to surpass their desktop in mobile engagement."

The challenge for retailers becomes earning the revenue per visit from mobile they get from desktop. They're not even able to get to half of what they gain from desktop visits, Gaffney said. So, in 18 months when the industry sees more mobile visits from smartphones, compared with desktops, retailers will suffer because the visits won't convert into sales.

"Maybe the problem is we don't know how to stitch together a shopping event with a previous mobile visit that ended up as a buy on a desktop, as opposed to a mobile site," Gaffney said. "But that's the way marketers need to look at mobile advertising if they want to attach it to an ROI calculation."

More interestingly, mobile search advertising isn't Google's only challenge. In a separate, but related study commissioned by Adobe to better understand the perceptions of consumers and media, 41% of the more than 400 U.S. consumers think Facebook display ads are more relevant, compared to the 17% who found Google display ads were more relevant, the majority of which are displayed on YouTube.