More streaming users ranked two leading free,

ad-supported services (FASTs) as providing “excellent” value than eight leading subscription-based video-on-demand (SVOD) services, in the latest video survey by Hub Entertainment

Research.

Hub surveyed 1,602 U.S. consumers ages 16 to 74, with broadband, in June.

Asked how much value they get from specific platforms, 41% of users of Tubi, and 39% of users

of Pluto TV, ranked them as excellent.

In comparison, Max and Discovery+ came in at 34%, Netflix, Apple TV+, Prime Video, and Disney+ at between 33% and 31%, and Hulu and Paramount+ at

29% and 27%, respectively (above). Those percentages represent responses from both users of the ad-supported and ad-free tiers of these services.

While the fact that FASTs are free helps

drive their high value perception, “growing investment in FAST content and user experience will continue to move the needle, as well,” notes Hub.

advertisement

advertisement

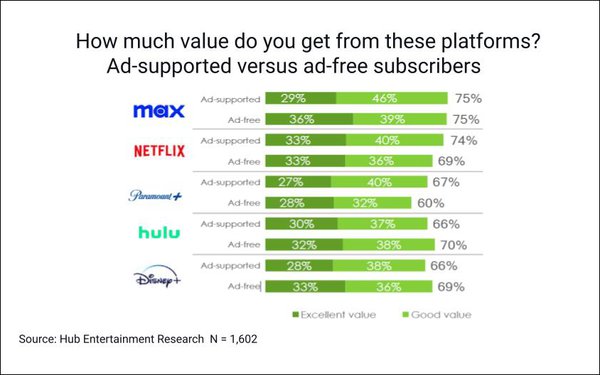

When perceptions of the

eight SVODs were broken out and weighted to represent the numbers of ad-supported versus ad-free subscribers for each tier, the two types of tiers show roughly the same rankings performance:

The reason, according to Hub:

With tiered plans, each user opts into the ad-supported or ad-free version, so “no one has to compromise.”

And at least attitudinally, ad-free services are somewhat

“stickier.” In aggregate, 78% of users of ad-free services said they will definitely or probably still have those services a year from now, while 71% of users of ad-supported services said

the same.

Not surprisingly, the

survey finds consumers saying that low price is the strongest driver of the value of a given video/TV service, but not the only consideration. They also want price stability and for a large library of

content.

Despite their concern

with cost, 44% of respondents report that they’re spending more on total TV (streaming, cable/satellite subscriptions, rentals etc.) than a year ago. That’s up from 34% saying the same in

2020. Further, they report spending $85 per month, which is 25% more than what they consider “reasonable” for television/video services.

Hub’s May survey found 63%

reporting that they use both traditional MVPD/cable/satellite pay-TV services and streaming services, 27% using streaming only, and 10% using traditional only. In the June survey, two thirds of those

who do not have a traditional service agreed that integrating SVODs into an MVPD set-top box would make a pay-TV service more valuable to them (up from 59% in 2022).

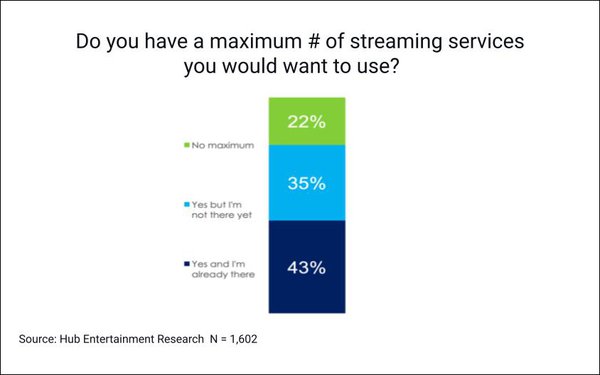

Like a survey

conducted by Hub in May, the June survey indicates that consumers are

reaching their limit for subscription services.

The new survey finds 78% confirming that they’ve decided on a maximum number of streaming services they would subscribe to, and 43%

of those saying they’ve already reached that limit.

Those already at their limit report using 7.3 services, on average, and the 35%

who say they have not yet reached their limit report having seven services, on average. In comparison, the average number of services among the 22% who say they’ve set no limit is 6.5.

That jibes fairly closely with the May survey, which found the average U.S. household reporting using 6.4 video services — down 14% from a peak of 7.4 reported to Hub in 2022.

The bad news for video services: The highest spenders are the most likely to churn. The more subscriptions a household has, the more likely they are to cancel a new subscription within six months

of signing up for it.

On average 55% of those with four or more subscriptions say they’ve cancelled a subscription within six months, versus 42% on average among respondents

overall.

And serial churn is

higher among key demographic segments. Well over half of Gen Z viewers, and those with children, have cancelled a subscription within six months of signing up.