Carat Cuts 2015 Global Ad Spend Forecast

- by Steve McClellan @mp_mcclellan, September 21, 2015

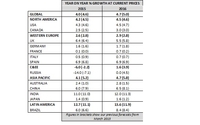

Carat, part of the Dentsu Aegis Network, has downgraded its global ad spend forecast for 2015. In

a just-issued forecast revision, the agency is predicting 4% growth for this year to $529 billion. Earlier this year the agency had forecast 4.6% growth. Next year spending is expected to grow by

another $25 billion (+4.7%).

The downgrade was attributed in part to economic volatility in China and Russia, as well as by lower-than-anticipated growth in radio and outdoor.

In the U.S., Carat is cutting its spending growth forecast for both 2015 and 2016. This year, the agency now believes growth will be 4.3% versus its 4.6% prediction in March. Next year, growth in the region is expected to be 4.5%, a bit lower than the 4.7% that the shop predicted earlier.

The forecast is based on data compiled from 59 markets across the Americas, Asia-Pacific and Europe, the Middle East and Africa.

advertisement

advertisement

By media, Carat said that digital will post double-digit growth this year and next (15.7% and 14.3% respectively). That will be driven by high demand for mobile and online video advertising (especially across social media), with 51.2% and 22% year-on-year growth expected this year.

Programmatic buying is also experiencing rapid growth at a rate of +20% each year. TV remains steady with 42.0% market share in 2015 and predicted growth of 3%-plus in 2016, in part due to the upcoming Olympic Games and U.S. elections.

Jerry Buhlmann, CEO of Dentsu Aegis Network, said: “Carat’s latest advertising spend forecast shows optimism balanced with realism during a year of increased volatility in major markets such as Russia and China. Noticeably, the landscape is becoming increasingly complex as previously grouped markets, such as the BRIC economies, are now operating differently and economic situations can quickly change markets at pace. “

Buhlmann added that “Digital media continues to achieve outstanding growth as the effectiveness of this medium and results achieved, especially with millennials, warrants the upsurge in spend levels.”

Carat’s revised report follows several other recent forecast downgrades.

We usually wait until the data for the first 11 months is in before issuing our projections for the year. That way we tend to be spot on almost all of the time.